What to do if your organization is tax-exempt?

What should I do if I believe my organization is tax-exempt?

If you believe your organization is exempt from state sales tax, you should have your account owner contact Zendesk Customer Support. They can help verify your tax-exempt status and ensure your account is billed correctly.

It's important to address this with Zendesk to avoid unnecessary charges on your invoice. For more information, you can refer to the originalZendesk help article.

More related questions

Why is there a sales tax on my Zendesk invoice?

Sales tax is added to your Zendesk invoice because subscriptions are subject to sales tax in certain US states. Since June 2013, Zendesk has been collecting sales tax in these jurisdictions, and the subscription prices listed do not include this…

Is sales tax included in Zendesk subscription prices?

No, sales tax is not included in the listed subscription prices for Zendesk. The prices you see do not account for sales tax, which is why it appears as an additional charge on your invoice. This is because Zendesk subscriptions are subject to…

When did Zendesk start collecting sales tax?

Zendesk began collecting sales tax in certain US states starting in June 2013. This means that if your subscription is subject to sales tax, it will appear as an additional charge on your invoice. The sales tax is not included in the listed…

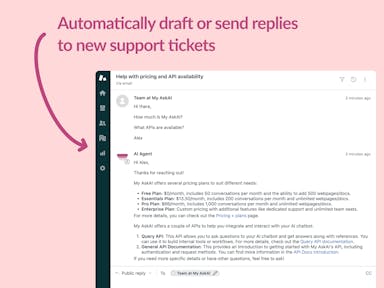

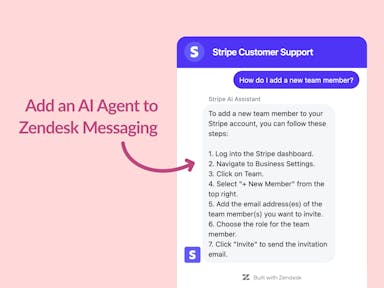

Interested indeflectingover 70% of your Zendesk support tickets?

Zendesk Support Tickets

Zendesk Messaging (live chat)

Join1,000+ companies reducing their support costs and freeing up support agents for more important work

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

Reduce support costs.Spend more time on customer success.