Understanding Payment Card Data for PCI DSS

What is considered payment card data under PCI DSS?

Payment card data under PCI DSS primarily refers to the Primary Account Number (PAN). If the PAN is stored, processed, or transmitted, PCI DSS compliance is required.

However, if other data elements like the cardholder name, expiration date, and security code are present without the PAN, PCI DSS does not apply. When these elements are stored with the PAN, they must be protected according to PCI DSS requirements. For more details, you can refer to thePCI Security Standards Council website.

More related questions

How does Zendesk help with PCI compliance?

Zendesk aids PCI compliance with its PCI Compliant Ticket Field, which redacts the Primary Account Number (PAN) to the last 4 digits before submission. This feature ensures that the payment card protection requirement for PCI compliance is met….

What is Zendesk's automatic redaction feature?

Zendesk's automatic redaction feature helps protect sensitive payment card data by redacting numbers between 12 and 16 characters to the first 6 and last 4 digits. This feature can be enabled in the Admin Center and applies to new data from the…

How can I manually redact payment card data in Zendesk?

To manually redact payment card data in Zendesk, you can use Data Loss Prevention (DLP) and API tools. First, export your Zendesk ticket data to a secure location. Then, use the Incremental API or Listing Comments API to pull the necessary data….

How can I determine if a system is in-scope for PCI compliance?

A system is in-scope for PCI compliance if it stores, transmits, or processes payment card data. To determine this, document all data flows and systems expected to handle payment card data, including those directly connected to these systems. Also,…

How can I make PCI DSS compliance more manageable?

To make PCI DSS compliance more manageable, reduce your PCI scope by reviewing your Cardholder Data Environment (CDE) and limiting data acquisition to what's necessary. Consider whether your business processes require payment card data and if you…

What is Zendesk's Attestation of Compliance (AoC)?

Zendesk's Attestation of Compliance (AoC) is an audit report demonstrating compliance with PCI DSS for subscribers using the Credit Card Field in Zendesk Help Desk and Help Center services. This AoC is available to Enterprise Subscription Plan…

Interested indeflectingover 70% of your Zendesk support tickets?

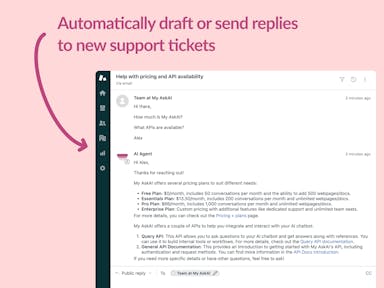

Zendesk Support Tickets

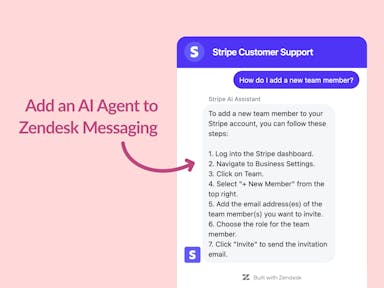

Zendesk Messaging (live chat)

Join1,000+ companies reducing their support costs and freeing up support agents for more important work

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

Reduce support costs.Spend more time on customer success.