Understanding VAT or GST Numbers for Businesses

What is a VAT or GST number and why is it important?

A VAT or GST number is a unique identifier for tax purposes. It is issued by a country's tax authority to businesses required to collect Value Added Tax (VAT) or Goods and Services Tax (GST). This number is crucial for businesses in certain countries to comply with tax regulations.

Countries like Singapore, India, Chile, Colombia, Norway, Switzerland, Turkey, and Brazil require businesses to register for a VAT or GST number. This number ensures that the correct amount of tax is collected and reported. If you're operating in these countries, it's important to have this number to avoid additional taxes on your purchases. For more details, you can refer to the originalZendesk article.

More related questions

How do I update my VAT or GST number in Zendesk?

You can update your VAT or GST number on the payments page in Zendesk's Admin Center. This is an important step to ensure your tax information is accurate. When updating, make sure the VAT or GST number corresponds to your shipping address, not…

What happens if I don't provide a VAT or GST number in Zendesk?

If you don't provide a VAT or GST number, Zendesk will levy the tax on your purchases. This is applicable if you're based in countries that require a VAT or GST number. Countries like Singapore, India, Chile, Colombia, Norway, Switzerland, Turkey,…

Which countries require a VAT or GST number for Zendesk users?

Zendesk requires a VAT or GST number for users in specific countries. These countries have regulations that mandate businesses to register for tax purposes. The countries include Singapore, India, Chile, Colombia, Norway, Switzerland, Turkey, and…

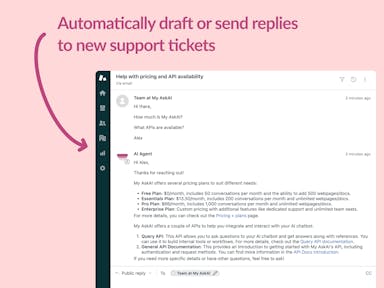

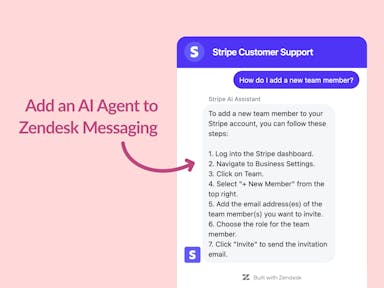

Interested indeflectingover 70% of your Zendesk support tickets?

Zendesk Support Tickets

Zendesk Messaging (live chat)

Join1,000+ companies reducing their support costs and freeing up support agents for more important work

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

“We needed an AI agent integrated within our current tools. My AskAI was the only solution that wasn't going to disrupt our operations.”

Zeffy

“At the end of last year I was given the challenge - how can we provide the same or better service, without hiring anyone?”

Zinc

“My AskAI blew everybody else out of the water. It made the selection process very easy for us.”

Customer.io($50M+ ARR)

“It now resolves 71% of queries (over 35,000 every month), meaning more time solving complex issues and improving UX.”

Freecash

Reduce support costs.Spend more time on customer success.